Lighthouz AI vs Manual AP/AR (ROI Breakdown)

The hidden cost of manual AP/AR is draining freight brokers’ and 3PLs’ time, money, and delaying cash flow, from processing carrier bills to sending customer invoices.

Discover how Lighthouz AI automates your AP/AR, reduces errors, and delivers measurable ROI, often paying for itself in months. See the numbers that CEOs, CFOs and Finance Directors can’t ignore.

The Hidden Cost of Manual AP/AR

Imagine this: Your AP specialist just spent 15 minutes untangling a duplicate carrier bill — cross-checking the Rate Confirmation, BOL, and carrier and factoring emails to confirm the same $1,320 charge was submitted three times. All this on just one shipment. These short delays add up over the course of the day. As a result, they weren’t able to send out all the customer invoices on time and make all the collections calls scheduled for the day. All this slows down the payment cycles, and impacts month-end reconciliation.

This scenario is common among freight brokers and 3PLs still relying on manual AP/AR. Beyond labor, hidden costs quietly accumulate such as late payment penalties on carrier bills, delayed customer invoicing, cash flow slowdowns, constant error corrections, burnt out staff, and frustrated leadership.

Before using Lighthouz, many AP teams would take 3 to 5 days approving a single carrier bill from receipt and sending customer invoice from the time of delivery. Even then, errors like duplicate carrier payments and missing accessorials (e.g., lumper) still slip through for nearly half of organizations. Manual AP and AR is more than just tedious. It quietly drains time, attention, and money from your operations and leads to burnt out staff and frustrated leadership.

After moving to Lighthouz, customers consistently bring customer invoicing within 24 hours of delivery days, while improving accuracy and reducing the daily workload on their accounting teams.

Lighthouz AI was built to eliminate this backoffice inefficiency – purpose-built for freight finance to deliver automation, accuracy, and measurable ROI by accelerating processing speed and improving cash flow without adding headcount.

The True Cost of Manual AP/AR Processing

A. Direct Costs

Manual processing drives up cost since every invoice demands human time, and that time scales linearly with load volume.

For freight operations:

- Cost per invoice: $12–$40

- Processing time: 3–5 days

- Error rate: errors remain common

Manual handling slows the cash cycle, increases labor costs, and creates error-prone workflows.

B. Hidden Costs / Opportunity Costs

Beyond direct labor, staying manual leads to significant lost opportunities:

- Late payment penalties: risk of extra fees from carriers and factoring companies

- Staff stuck on tactical work: 2+ hours per person per day could be spent on improving cash flow and other strategic finance tasks.

Manual workflows slow approvals, which can result in late payments to carriers and factoring companies, increasing penalties and operational risk.

C. Common Carrier Bill Exceptions

Freight finance introduces additional complexity. Common billing exceptions for truckload shipments include:

- Incorrect billing $ amounts – leads to back-and-forth with ops team and carrier for resolution

- Duplicate carrier bills — the same load’s bill approved or paid twice

- Missing or incorrect BOL/POD details — delays approvals, invoicing, and payments

- Unsigned PoDs

- Damages, overages, shortages, receiver complaints – can lead to claims and resolution delays

- Delayed delivery – can lead to penalties and payment delays

- Remit-to differences – invoice says pay to Factor A while TMS says Factor B, requires back-and-forth resolution with carrier and factoring companies

- Misapplied or overlooked advances — may cause overpayments

Each of these exceptions snowball into stalled payments, and higher labor spend, turning minor issues into real financial leakage.

How Lighthouz AI Automates AP/AR

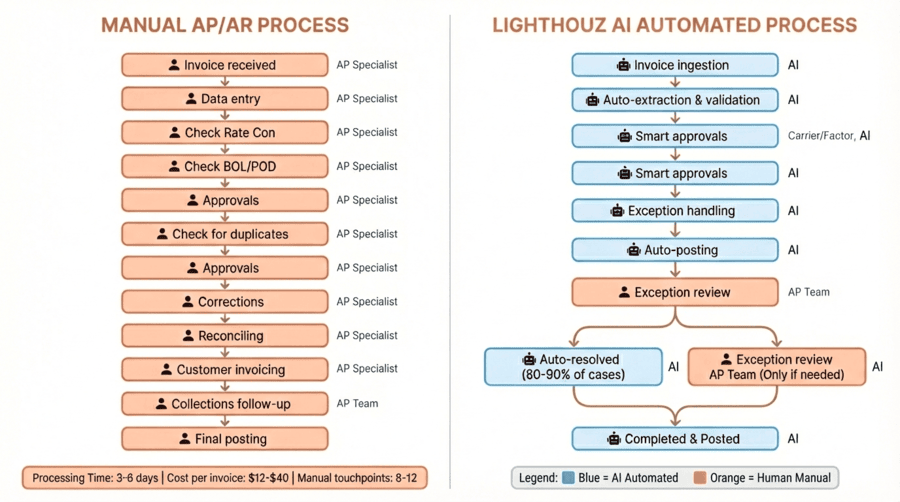

A. Automated Workflow

Lighthouz AI replaces manual steps with a smarter pipeline with minimal human intervention:

1. Document Ingestion: Auto-label invoices, BoLs, PODs, receipts, lumpers, etc received via email, EDI, or uploads.

2. AI Extraction & Structuring: Structured freight fields pulled with 99.1% accuracy: bill-to, remit to information, load id, invoice id, pro #, line item charges and accessorials, pro #, pickup and drop off locations, signatures, hand-written notes, and more. Lighthouz AI engine extracts everything that’s on the documents.

3. Contracted Rate Verification: Instant matching against Rate Cons / Quotes, no lookup required.

4. Exception Detection: Lighthouz conducts 45+ audit checks on every submitted document to flag rate mismatches, duplicate invoices, invalid accessorials, missing PODs, missing PoD pages, unsigned PoDs, mismatched factoring companies, wrong carriers billed, and more.

5. Smart Approvals: Clean carrier bills are auto-approved based on your business rules. For certain exceptions, Lighthouz AI automatically resolves them by contacting the right internal teams or external parties (carrier or factoring companies) to get missing information. This speeds up processing and reduces manual work.

6. Invoicing customers. AI automatically uploads PoDs and approves customer invoice to be sent out to the customer.

7. Auto-Data Entry into TMS: Clean, validated data posts directly into your TMS with no double entry.

8. Audit Trails + Analytics: Every decision is logged; finance leaders get real-time dashboards with visibility on exception rates and root causes, which leads to informed decision making.

B. Freight-Specific Advantages

- Speed: 3-6 days → less than 24 hours

- Accuracy: Enforces rate compliance automatically

- Zero IT lift: Plug into your TMS and accounting system with just a few clicks

- Integrates with existing systems, no additional IT overhead.

In addition, Lighthouz handles all complex freight scenarios: multi-stop shipments, Multi-load PDFs, missing pages, rotated scans, handwritten accessorials, LTL re-bills, POD bundling

Lighthouz isn’t generic automation — it is freight-native intelligence.

Strategic Benefits Beyond Numbers

A. Cash Flow Visibility

Lighthouz AI provides real-time insight into invoices, approvals, and payments, reducing month-end surprises and enabling finance teams to manage working capital proactively.

Companies can now anticipate cash flow needs and make better-informed financial decisions, instead of scrambling to invoice customers and chase payments.

B. Quick customer invoicing

Accurate, on-time payments strengthen partnerships, improve supplier trust, and reduce disputes.

With automation, carriers and vendors experience fewer payment delays and errors, which enhances long-term collaboration and can even create opportunities for early payment discounts or negotiated terms.

C. Carrier Relationships

Accurate, on-time payments strengthen partnerships, improve carrier and factor trust, and reduce disputes.

With automation, carriers and factors experience fewer payment delays and errors, which enhances long-term collaboration and can even create opportunities to get better rates.

C. Scalability

Automated AP teams can process 4–5x more carrier bills per person than manual processing. One AP specialist who handles ~750 bills per month manually can manage 3,500–3,750 bills monthly with Lighthouz AI, maintaining accuracy and speed.

D. Audit & Compliance Readiness

Full digital trails and AI-verified records make audits faster, easier, and less stressful, mitigating compliance risk. Every invoice, approval, and payment is logged and traceable, ensuring companies can respond confidently to internal audits, regulatory reviews, financial reporting requirements, and resolve disputes efficiently.

This highlights both audit and dispute-handling efficiency in one point.

E. Team Morale

Staff are freed from repetitive, error-prone tasks and can focus on work that actually moves the business, like improving cash flow, negotiating better terms, and driving process improvements.

Reducing tedious work also boosts engagement and retention, particularly in high-turnover logistics finance teams.

F. AR Automation Statistics

With AR automation:

- Payments from customers are processed on time

- Fewer customer disputes occur

- Cash application becomes more predictable

- Finance teams gain better visibility and control over receivables

Your AR becomes a revenue enabler, not a bottleneck.

ROI Breakdown: Manual vs Lighthouz AI

Automation is not just convenient; it drives efficiency and measurable savings.

| Metric | Manual Process | Lighthouz AI | Notes |

| Invoices/month handled per AP person | 750 | 3,000 | 4x increase in AP throughput |

| Cost per invoice | $25 | $3 | Reduced labor and errors |

| Processing time | 3–5 days | <24 hours | Speeds cash flow |

| Labor hours | 500 hrs/month | 75 hrs/month | Reduced workload per AP staff |

| Billing errors and overpayments | Common | Significantly fewer | Automation reduces mistakes |

| Customer payment cycle | Variable | Improved | Quicker invoicing leads to faster customer payments |

| Total Annual Savings | – | ~4× cost savings | Includes labor, error reduction, and operational efficiency |

Lighthouz AI Implementation Costs

- Software: $XX,000/year

- Implementation: $X,000 one-time

- Training: Minimal

Payback period: Typically within months

ROI first year: High, with further gains in subsequent years

ROI Formula for CFOs:

ROI = (Hours saved × labor rate) + (Errors reduced × cost per error) + (Late payment penalties avoided) – Cost of Lighthouz AI

NAD Logistics Case Study

- Invoice processing time reduced by 78% (2.11 days → 0.47 days)

- Saves 90–120 minutes daily per accounting team member

- Full ROI achieved in under 6 months

This example shows how quickly freight teams can eliminate manual workload and unlock measurable operational gains.

Learn more about how NAD Logistics transformed their AP operations

The Cost of Waiting

Manual AP/AR is expensive, and delay compounds losses:

- Based on modeled invoice volume and labor benchmarks, each month of continued manual processing can result in $40K–$45K in improved cashflow and avoidable costs.

- Competitors automating first gain a cash flow advantage, which they use to win more freight and customers.

- Errors accumulate, penalties happen, audits become harder, and staff frustration grows.

The longer you wait, the higher the hidden tax on your operation.

Getting Started

Implementation Timeline:

- Weeks 1–2: Assessment, Planning, Integration, and Training

- Weeks 3–4: Workflow and Audit Customization

- Month 2: First measurable savings

- Month 3-6: Full ROI achieved

Start now to stop losing time and money to manual AP/AR. Every day counts toward savings.

In just one session, see a personalized ROI calculation tailored to your operations and learn how quickly automation can pay for itself.

Summary

Manual AP/AR quietly drains time, attention, and money from freight operations. Every day spent on invoice errors, delayed customer billing, and duplicate work reduces profitability and distracts your team from strategic priorities.

Lighthouz AI automates AP/AR, cuts errors, accelerates processing, avoids late payment penalties, and delivers measurable ROI in months. Stop losing time and money to manual processes and reclaim accuracy, speed, and control over cash flow.

The longer manual work continues, the greater the operational and financial impact — making automation a financial must-have, not a nice-to-have.

Next Step

Book a 15-Minute Lighthouz AI ROI Review → See exactly how much your freight finance team can save.