How AP/AR Automation Integrates With Your TMS (Without IT Help)

AP and AR automation are no longer a “nice-to-have” for finance teams of brokers and 3PLs; it’s strategic. According to research, 78% of CFOs view AI integration as crucial for accounts payable and receivables to improve efficiency, accuracy, and cash flow management.

However, despite clear benefits, adoption often lags due to perceived integration challenges with TMS, accounting systems, and payment systems.

Brokers and 3PLs attempting to modernize backoffice consistently list data quality and integration complexity as top barriers. A Deloitte survey highlights that 62% of organizations cite difficulty integrating automation tools with existing systems as a key challenge, and 55% say lack of skills adds friction to scaling automation.

For freight brokers, the Transportation Management System (TMS) is the operational backbone that contains load details, rates, accessorials, and billing logic. The fear of disrupting this system through integration work often slows automation projects before they even begin.

This is where Lighthouz AI changes the equation.

Its freight-native platform ensures AP/AR automation integrates with your TMS seamlessly, along with accounting and payment systems—without internal IT lift or workflow disruption. As a result, brokers can deploy automation in days and start seeing measurable business impact within weeks.

Why Integrations AreSeemingly the Biggest Barrier to Automation

Accounts payable and receivables automation promises efficiency, reduced errors, and better cash flow. Yet many teams never get past the starting line because technical ownership remains a top challenge.

For freight brokers and 3PLs, this challenge is intensified. The TMS isn’t just another tool. It’s the system of record that drives rate logic, accessorial calculations, and invoice generation. Disrupting it or requiring custom engineering work to connect new systems can threaten operational stability.

Gartner research shows that over half of finance organizations are adopting AI, but data quality and integration issues remain major obstacles to scaling automation across finance functions

As a result, many brokers’ finance teams adopt only partial automation or delay projects altogether, leaving manual processes in place longer than necessary.

While many automation tools focus on a single system, real finance transformation requires seamless integration across the TMS, accounting platforms, and payment systems.

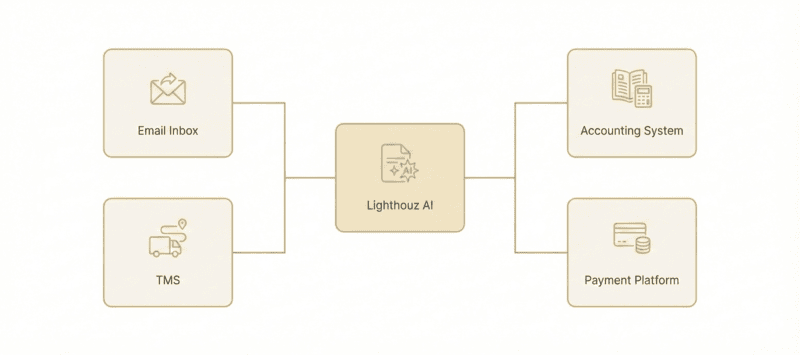

The Modern AP/AR Stack for Freight Brokers

To grasp how automation should fit in, it helps to visualize the finance and operations tech stack:

- TMS (Transportation Management System): Source of truth for operational data, including loads, rates, accessorials, billing rules, and settlement logic.

- Accounting Systems (e.g., QuickBooks): The financial ledger where validated invoices are posted, reconciled, and reported.

- Payments Platforms (e.g., TriumphPay): Systems that execute carrier payments and manage receivables.

- Email Inbox: Platform where carriers and factors submit invoices, PoDs, and receipts

Lighthouz AI acts as the connective layer between these systems, transforming operational data into clean, auditable financial transactions. When integration is seamless, finance teams can reduce manual effort, errors, and cycle times without disrupting the TMS.

Cloud-native and AI-enabled automation platforms are increasingly used because they support real-time sync, flexible workflows, and easier connectivity compared to legacy on-prem systems. Source: ResearchIntelo

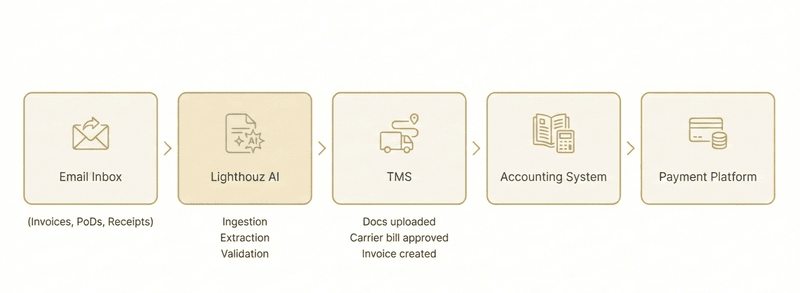

How AP and AR Automation Flows Across Email, TMS, Accounting, and Payments

AP and AR automation works best when it fits into existing finance and operations workflows, without modifying the workflows. For freight brokers, this means starting at the inbox and connecting every downstream system without manual handoffs.

Here’s how the end-to-end workflow works in practice:

- Invoices arrive via email: Carriers and factors send invoices, PoDs, and receipts directly to the AP inbox.

- Lighthouz AI ingests invoices automatically: Emails and attachments are picked up without forwarding or uploading.

- Invoice data is extracted and validated: Invoice details are checked against shipment data from the TMS.

- TMS is updated, and invoices are generated: Documents are uploaded to the TMS and carrier bill is approved on the TMS, and customer invoices are created.

- Accounting and payments are updated: Clean data flows into accounting systems and payment systems, triggering payments and receivables.

Behind the Scenes: How Lighthouz AI Is Implemented Without IT Lift

After understanding the AP and AR workflows, the next question is often:

How hard is it to implement?

When AP/AR automation integrates with your TMS, implementation is handled by the Lighthouz AI team within a couple of days, with minimal effort required from the broker’s team. There is no disruption to existing workflows or systems.

Lighthouz AI is built to work seamlessly with your current stack.

Step 1: Secure Connections to TMS and Email

- Lighthouz AI connects securely to the broker’s TMS and AP email inbox.

- Connection with the TMS requires creation of an API key on the TMS and sharing with the Lighthouz AI team

- Email integration is a two-click process or can be set up as an auto-forward

- No internal development is required by the broker

This allows automations to start immediately and safely

Step 2: Automatic Data Ingestion

- Once connected, Lighthouz AI pulls data from the email and the TMS automatically:

- Load details, rates, and accessorials are pulled from the TMS whenever required

- Invoices and documents from email

This removes manual exports, spreadsheets, and delays.

Step 3: AI-Based Validation of Freight Bills

- Lighthouz AI cleans and validates data automatically:

- Classifies emails and document pages

- Extracts all information from the freight bill, PoDs, and receipts, even when the documents are in PDF or image format

- Checks all charges against the TMS shipment data

Only accurate, validated data and documents move forward. Any mismatches are flagged as exceptions.

Step 4: Continuous Sync Across Systems

- Throughout the entire process, the system stays in sync automatically:

- Data flows from emails to TMS

- TMS updates flow into accounting and payment systems

- Clean freight bills process on their own with zero human touch. Only real exceptions need review.

Lighthouz AI connects TMS, accounting, and payments as one continuous workflow, eliminating ongoing IT dependency while allowing automation to scale.

This model enables best ROI in automation adoption, in which systems allow scaling while reducing manual touchpoints.

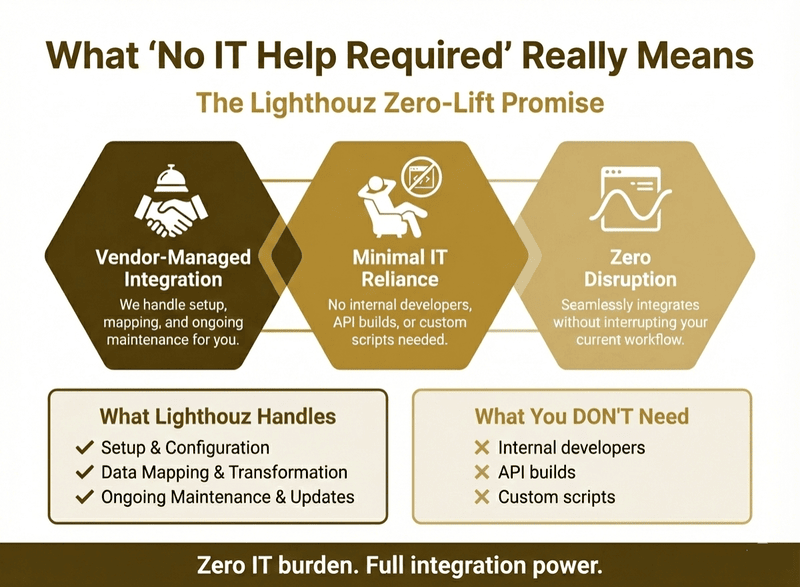

What “No IT Help Required” Really Means

The phrase “no IT lift needed” is often overhyped, but with Lighthouz AI, it’s operationally real:

- Lighthouz-managed integration: Lighthouz takes care of the entire integration, from setup to mapping to maintenance.

- Minimal reliance on internal IT: Brokers don’t need internal developers, API builds, or custom scripts.

- No disruption to existing workflows: TMS configurations remain unchanged, reducing risk and speeding implementation.

This Lighthouz-driven approach directly addresses the integration challenges identified by Deloitte, where nearly two-thirds of organizations struggle to connect new automation tools with existing systems.

This same vendor-managed approach applies across the full financial stack, including the TMS, accounting platforms like QuickBooks, and payment systems, eliminating the need for separate integration projects.

As a result, brokers can move from decision to deployment faster, without the delays that typically stall automation initiatives.

How Lighthouz AI Connects Accounting and Payments

Once TMS data is normalized and validated, Lighthouz AI pushes clean, structured carrier bill approvals and customer invoice approvals into your accounting and payment platforms. This significantly reduces manual data entry work.

From there, automated payment workflows trigger carrier payouts and customer collections more quickly and with fewer errors, improving cash flow and shortening settlement timelines.

This seamless financial pipeline is what many organizations aim to achieve when adopting automation, but often fail to realize due to integration complexity. By automating the flow of data from operations to finance and payments, Lighthouz AI delivers clear, measurable business value.

Common Integration Concerns – And How Lighthouz AI Solves Them

1. Will it disrupt our TMS usage or TMS workflows?

No. The integration is scoped and non-invasive and is designed to respect your existing systems and processes.

2. Our TMS data isn’t perfect.

No problem. AI-enabled normalization adapts to real-world data inconsistencies without requiring upfront cleanup.

3. Integration takes too long.

Lighthouz-managed connectors typically go live within two days, not months, even without internal technical resources.

4. What happens when our TMS setup changes?

Lighthouz maintains the integration as systems evolve, adjusting to configuration or data changes to keep workflows running smoothly without added effort from your team.

5. Will this create ongoing IT dependency?

No. Lighthouz AI owns integration monitoring, updates, and maintenance, so brokers are not pulled into long-term technical support or troubleshooting.

6. How are exceptions and edge cases handled?

The system automatically processes clean invoices and routes only true exceptions for human review, ensuring automation increases control rather than hiding issues.

The Operational Impact of TMS-First AP/AR Automation

When AP/AR automation is integrated directly with the TMS, the impact is measurable across finance operations.

Invoicing customers becomes faster as finance teams spend less time on manual data entry and correcting errors. Costs per invoice decline because automated workflows reduce labor effort and limit exception handling.

At the same time, continuous data synchronization improves cash flow visibility, giving teams better insight into forecasting and working capital management.

Case in Point: NAD Logistics + Lighthouz AI

In a real-world deployment, NAD Logistics partnered with Lighthouz AI to automate carrier bill audits and streamline finance operations:

- Average time to invoice customers dropped from ~2.11 days to ~0.47 days – i.e., NAD is now invoicing customers within 12 hours of delivery

- The accounting team saved an estimated 90–120 minutes of manual work daily.

- Manual paperwork use declined sharply as automation replaced repetitive tasks.

This case underscores how automation integrations, when handled by a vendor with deep domain expertise, can scale operational capacity without adding headcount.

Together, these capabilities enable end-to-end financial automation, with data flowing from the TMS into accounting and payments without manual handoffs, reducing delays across the procure-to-pay and invoice-to-cash cycle.

Conclusion – Automation Without Friction

AP and AR automations do not fail because they lack value. They fail when integration turns into an internal IT project. When automation is seamless, vendor-managed, and aligned with existing operational systems like the TMS, it becomes an accelerant rather than a blocker.

With Lighthouz AI’s TMS-first, fully-managed integration approach, freight brokers and 3PLs can automate finance workflows without relying on internal IT.

This reduces invoice and settlement cycle times while improving cash flow visibility and forecasting accuracy. As a result, finance teams are able to focus on strategic priorities instead of manual, repetitive tasks.

Integration should be invisible. The results should be unmistakable.